Special depreciation allowance calculator

The old rules of 50 bonus depreciation still apply for qualified assets acquired before September 28 2017. If entering in the Direct Input screen for.

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

These assets had to be purchased new not used.

. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. If so are you referring to appliances or something. Depreciation Calculation Determine the basis of the property Determine the percentage of business use vehicles and offices Multiply the basis by the percentage of business use.

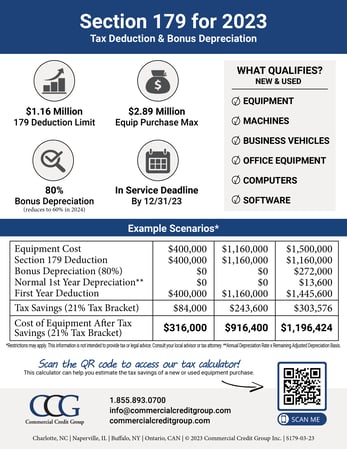

The new rules allow for 100 bonus expensing of assets that are new or used. The percentage of bonus depreciation phases down in 2023 to 80 2024 to 60 2025 to 40 and 2026 to 20. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

A change from claiming a 50 special depreciation allowance to claiming a 100 special depreciation allowance for qualified property acquired and placed in service by you after. The special depreciation allowance allows you to claim 50 or 100 of the cost of buying a qualifying asset in the first year you use it for business. The program automatically computes a special depreciation allowance for property placed in service in 2020 when the asset has MACRS depreciation method of 20 years or less.

For qualified property placed in service in 2017 you may be able to take an additional 50 or 100. The program will automatically calculate special depreciation allowance when applicable if the asset is entered in the Depreciation input screen. The allowance applies only for the first year you place the property in service.

Where Di is the depreciation in year i. To understand how to calculate depreciation tax deductions use Form 4562 Depreciation and Amortization and enter the result on Schedule C. After that the first-year bonus depreciation reduces.

General depreciation cost of fixed assets special depreciation x 20. Except for qualified property eligible for the special depreciation allowance. See the tables for limitations.

The MACRS Depreciation Calculator uses the following basic formula. Our car depreciation calculator uses the following values source. For the most part the building itself does not qualify for the Special Depreciation Allowance.

This special depreciation allowance is included in the overall limit on depreciation and section 179 expense deduction for passenger automobiles. Dont refigure depreciation for the AMT for the. The Tax Cuts and Jobs Act enacted at the end of 2018 increases first-year bonus depreciation to 100 for qualified property acquired and placed in service after September 27 2017 and before January 1 2023.

The allowance for bonus. Total Depreciation for Y1 year 1 special. After two years your cars value.

Figure the special depreciation allowance by multiplying the depreciable basis of qualified reuse and recycling property certain qualified property acquired before September 28. After a year your cars value decreases to 81 of the initial value. The calculator makes this calculation of course Asset Being Depreciated -.

Special depreciation cost of fixed assets x 40. C is the original purchase price or basis of an asset. D i C R i.

Just to double check when you say rental property so you mean a building that you rent out. Depreciation not refigured for the AMT. Starting September 28th 2017 the Special.

Use all three of those and any Section 179 to calculate the total depreciation. The Special Depreciation Allowance gives you 50 of that deduction in the first year then the other 50 is depreciated as usual. Taxpayers may elect out of the additional first-year depreciation.

Macrs Depreciation Calculator Straight Line Double Declining

Section 179 Calculator Ccg

Macrs

Free Macrs Depreciation Calculator For Excel

1

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

How To Calculate Depreciation Youtube

Macrs Depreciation Calculator Irs Publication 946

Section 179 Calculator Ccg

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Macrs Tables And How To Use

1

Macrs Depreciation Calculator Based On Irs Publication 946

Appliance Depreciation Calculator

1

Macrs Depreciation Calculator Irs Publication 946